Jammu & Kashmir Department of Revenue: Roles & Services Explained

Introduction to the J&K Department of Revenue

The Jammu & Kashmir Department of Revenue is the primary government authority responsible for managing land records, revenue administration, and land-related services in Jammu and Kashmir. Any service related to land ownership, land maps, Jamabandi, mutation, or property records in J&K ultimately falls under the supervision of this department.

Who Manages Land Records in Jammu & Kashmir?

Land records in Jammu & Kashmir are officially managed by the Department of Revenue, working through district-level and local revenue offices.

These include:

- District Collector / Deputy Commissioner offices

- Tehsil and Sub-Tehsil offices

- Patwari and Girdawar circles

- Revenue courts and survey authorities

Together, they ensure that land ownership, boundaries, and transactions are properly recorded and updated.

Main Responsibilities of the J&K Revenue Department

The Department of Revenue handles a wide range of land-related responsibilities, including:

- Maintenance of land ownership records

- Preparation and updating of Jamabandi

- Supervision of land surveys and mapping

- Processing land mutation cases

- Collection of land revenue

- Resolution of land disputes

- Digitization of land records

Its role is crucial in ensuring transparency and accuracy in land administration.

Land Records Services Provided by the Revenue Department

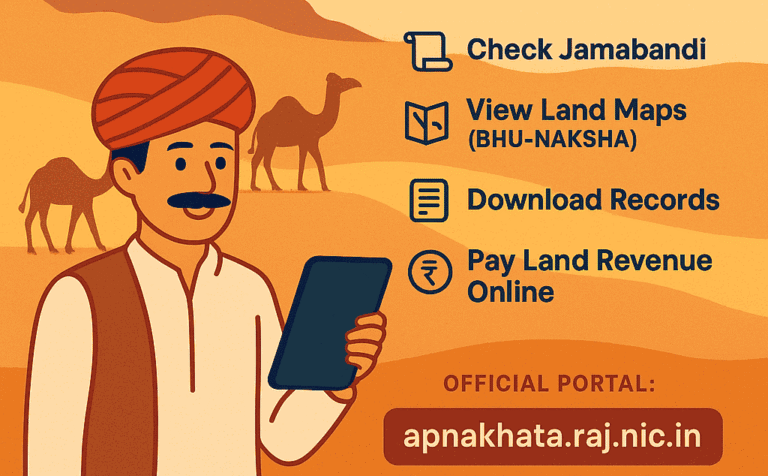

The J&K Revenue Department provides access to several important land record services, both offline and online.

Key Land Record Services Include:

- Jamabandi (Record of Rights)

- Land mutation (ownership change)

- Khasra and Khewat records

- Bhunaksha (land maps)

- Revenue extracts and certified copies

Many of these services are now available through the Land Records Information System (LRIS).

Role of the Revenue Department in Jamabandi Records

Jamabandi is the most important land ownership document in Jammu & Kashmir. The Revenue Department is responsible for:

- Preparing Jamabandi entries

- Recording owner names and shares

- Updating land classification and usage

- Correcting errors through official procedures

Patwaris update records at the village level, while higher officials verify and approve changes.

How the Revenue Department Handles Land Mutation

Land mutation refers to updating ownership details after events such as:

- Sale or purchase

- Inheritance

- Gift or partition

The Revenue Department verifies:

- Ownership documents

- Land location and boundaries

- Supporting Jamabandi and Bhunaksha records

Only after verification is mutation approved and reflected in official records.

Revenue Department’s Role in Bhunaksha and Land Mapping

The Department of Revenue oversees land surveys and mapping activities. Through Bhunaksha:

- Village-level land maps are digitized

- Plot boundaries are recorded visually

- Land parcels are linked with records

These maps help officials and citizens understand the physical layout of land, reducing disputes caused by unclear boundaries.

Importance of the Revenue Department in Property Transactions

Before buying or selling land in J&K, records maintained by the Revenue Department are used to:

- Verify ownership

- Check land classification

- Confirm plot boundaries

- Identify legal issues or disputes

This makes the department central to safe and legal property transactions.

Online Land Records and Digital Initiatives

To improve transparency and public access, the J&K Revenue Department has introduced digital platforms where citizens can:

- View Jamabandi records online

- Check mutation status

- Access land maps

- Verify land details without visiting offices

These initiatives reduce dependency on middlemen and physical paperwork.

Common Issues Handled by the Revenue Department

The department regularly addresses problems such as:

- Boundary disputes

- Ownership conflicts

- Errors in Jamabandi entries

- Missing land records

- Delay in mutation updates

Citizens can approach local revenue offices for resolution.

Why the J&K Revenue Department Matters to the Public

The Department of Revenue plays a key role in:

- Protecting land ownership rights

- Preventing land fraud

- Ensuring accurate land documentation

- Supporting legal and property transactions

Without proper revenue records, land ownership cannot be legally established.

Conclusion

The Jammu & Kashmir Department of Revenue is the backbone of land administration in the region. From maintaining Jamabandi records to supervising land maps and mutation processes, the department ensures that land ownership remains clear, lawful, and transparent. Anyone involved with land or property in Jammu & Kashmir must understand the role of the Revenue Department.

Stay informed with trusted land record articles and guides available on Bhulekh India.

Frequently Asked Questions

The Revenue Department of the Government of J&K handles the maintenance and supervision of land records.

Yes, Jamabandi records are prepared, maintained, and updated under the supervision of the Revenue Department.

Yes, land maps and Bhunaksha records are maintained through surveys conducted under the Revenue Department.

Ownership changes are updated through the land mutation process handled by the Revenue Department.

Yes, many land record services are available on J&K land records portal.

Read Also: J&K Land Records Information System: Check J&K Jamabandi Records Online

Read Also: Bhunaksha J&K: View Jammu & Kashmir Land Maps Online

Explore Categories: